Should I Rent or Buy a House in Davenport, FL?

Your complete guide to making the smartest move in Central Florida’s fastest-growing city.

Get Your Free Rent vs Buy Analysis

Not sure what’s right for you? I’ll run the numbers for your situation—no obligation.

Book Your Free Consultation or call/text: 954-418-2463 ¿Prefieres español? ¡Envíame un mensaje!Why First-Time Buyers Choose Davenport Over Orlando

- Lower property taxes than Orange County

- New construction homes under $400k

- Top-rated Polk County schools

- Vacation rental investment opportunities

- Easy I-4 access to Tampa and Orlando

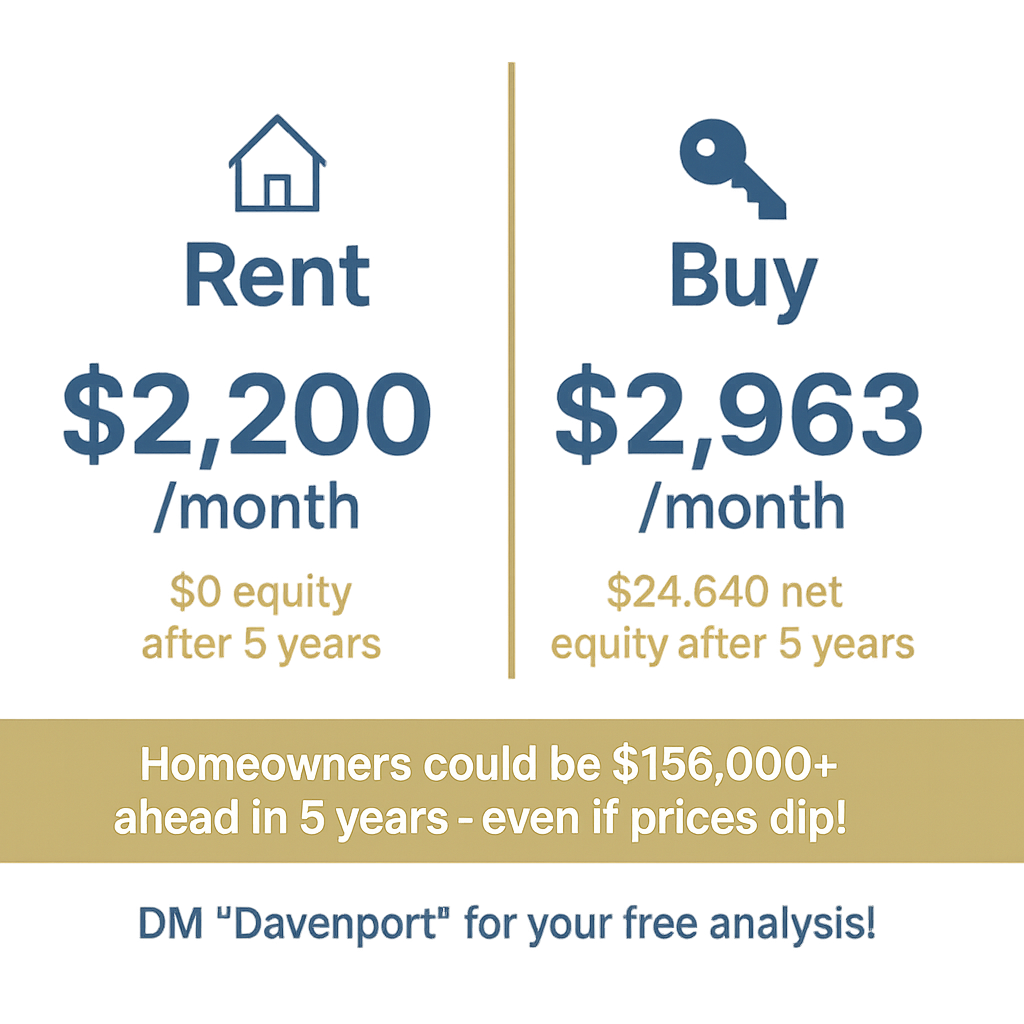

Rent vs Buy: The Real Numbers (June 2025)

| Rent | Buy | |

|---|---|---|

| Monthly Cost | $2,200 | $2,963 |

| Upfront Costs | $4,400–$6,600 | $83,000–$97,000 |

| 5-Year Net Worth Change | -$132,000 | +$24,640 |

| 5-Year Wealth Difference | Homeowners could be $156,000+ ahead—even if prices dip! | |

When Does Renting Make Sense?

- Planning to move within 2-3 years

- Need maximum flexibility

- Building credit or saving for a larger down payment

When Is Buying Smarter?

- Staying in Davenport 3+ years

- Want to build long-term wealth

- Ready for homeownership responsibilities

- Seeking tax advantages

Unlock First-Time Buyer Programs

FHA, VA, USDA, and Florida state programs can help you buy with as little as 0–3.5% down. I’ll show you how!

Email Me for Program InfoBest Davenport Neighborhoods for First-Time Buyers

- Providence – New construction, family-friendly

- Windsor at Westside – Resort-style amenities

- Solara Resort – Vacation rental potential

- ChampionsGate – Golf course community

- Ridgewood Lakes – Established neighborhood values

Frequently Asked Questions

Is it cheaper to rent or buy in Davenport, FL?

Renting costs less monthly, but buying builds wealth and offers tax benefits that often make ownership more cost-effective long-term.

What credit score do I need to buy?

FHA loans: 580+ (3.5% down), 500+ (10% down). Conventional: 620+ for best rates.

How much down payment do I need?

As little as 3–3.5% down with FHA, or 0% down with VA/USDA if eligible.

Are home prices going up or down?

Prices have corrected after rapid growth, creating opportunities for prepared buyers in 2025.

Contact Me

Call or Text: 954-418-2463 Email: ndperez729@gmail.com Schedule a Free Consultation ¿Prefieres español? ¡Perfecto! Servicios completos en español.Rent or Buy in Davenport, FL?

The Complete 2025 Financial Guide for First-Time Homebuyers

The Monthly Cost Showdown

At first glance, renting seems cheaper month-to-month. But owning a home involves building your own wealth, not your landlord's. This chart breaks down the typical monthly expenses for both options in Davenport.

| Type | Rent | Mortgage | Property Taxes | Insurance | Maintenance |

|---|---|---|---|---|---|

| Renting | $2,200 | $0 | $0 | $0 | $0 |

| Owning | $0 | $1,923 | $369 | $367 | $304 |

While the total monthly cash outflow is higher for owners, a significant portion of the mortgage payment goes towards principal, which is an investment in your own asset.

The Upfront Hurdle

The biggest barrier to homeownership is often the initial cash required. Here’s a clear look at the upfront costs you can expect for renting versus buying.

Upfront Renting Costs

$4,400 - $6,600

Typically includes first and last month's rent plus a security deposit. It gets you in the door, but doesn't build any equity.

Upfront Buying Costs

$82k - $96k

This covers your down payment (20% assumed) and closing costs. It's a significant investment, but it's the first step toward building long-term wealth.

The 5-Year Financial Journey

This is where homeownership truly starts to shine. Over five years, the financial outcomes for renters and buyers diverge dramatically. See how your net worth is affected in each scenario.

| Scenario | Net Worth Change (5 Years) |

|---|---|

| Renter | -$132,000 |

| Homeowner | $9,640 |

Even in a market with slight depreciation, the principal paid down on a mortgage results in a positive net worth change for homeowners, while rent payments represent a pure expense.

Davenport Market Snapshot (2025)

The local housing market is more balanced than in previous years, offering new opportunities. Here's a look at key trends affecting buyers.

| Date | Home Price Index | 30-Year Fixed Rate (%) |

|---|---|---|

| Jun 2024 | 101 | 7.05 |

| Sep 2024 | 100.5 | 7.10 |

| Dec 2024 | 100.2 | 6.80 |

| Mar 2025 | 99.5 | 6.95 |

| Jun 2025 | 100 | 6.93 |

Price appreciation has moderated to more sustainable levels, and while interest rates are elevated, they remain within historical norms. Inventory is also improving, giving buyers more choices.

Which Path is Right For You?

Beyond the numbers, your personal timeline and goals are key. Follow this simple flow to see which option might better suit your current life plans.

Renting offers more flexibility.

Buying makes more financial sense.

Help is Available!

Don't let the upfront cost of buying intimidate you. Numerous programs exist specifically to help first-time homebuyers make their dream a reality.

- ✅ FHA Loans: Require as little as a 3.5% down payment.

- ✅ VA Loans: Offer 0% down for qualifying veterans and service members.

- ✅ USDA Loans: Provide 0% down options in eligible rural areas.

- ✅ Local & State Aid: Programs can offer up to $10,000 in down payment assistance.

FEATURED LISTINGS

Davenport’s real estate market is active, with new listings coming on every week. Inventory is up compared to last year, giving buyers more choices and a bit more negotiating power. Whether you’re looking for a starter home or something bigger, now’s a great time to explore what’s available in Davenport.

MORTGAGE CALCULATOR