Rent vs Buy Calculator Davenport FL: 2025 First-Time Homebuyer Guide

Should I rent or buy a house in Davenport, Florida? This comprehensive guide breaks down real costs, market trends, and smart strategies for first-time home buyers in Central Florida's fastest-growing city.

Why First-Time Buyers Choose Davenport, FL Over Orlando

Davenport, Florida real estate offers unbeatable value for homebuyers seeking affordable homes near Orlando. This family-friendly community provides small-town living with big-city access—just 30 minutes from Disney World, Universal Studios, and downtown Orlando job centers.

Key Davenport advantages for homebuyers:

- Lower property taxes than Orange County

- New construction homes under $400k

- Top-rated schools in Polk County

- Growing vacation rental investment opportunities

- Easy I-4 access to Tampa and Orlando

The local housing market reflects increasing demand from young families, remote workers, and buy-and-hold investors, making it essential to understand current rent vs buy economics before making your move.

Davenport FL Housing Market Analysis: Current Rent vs Buy Costs (June 2025)

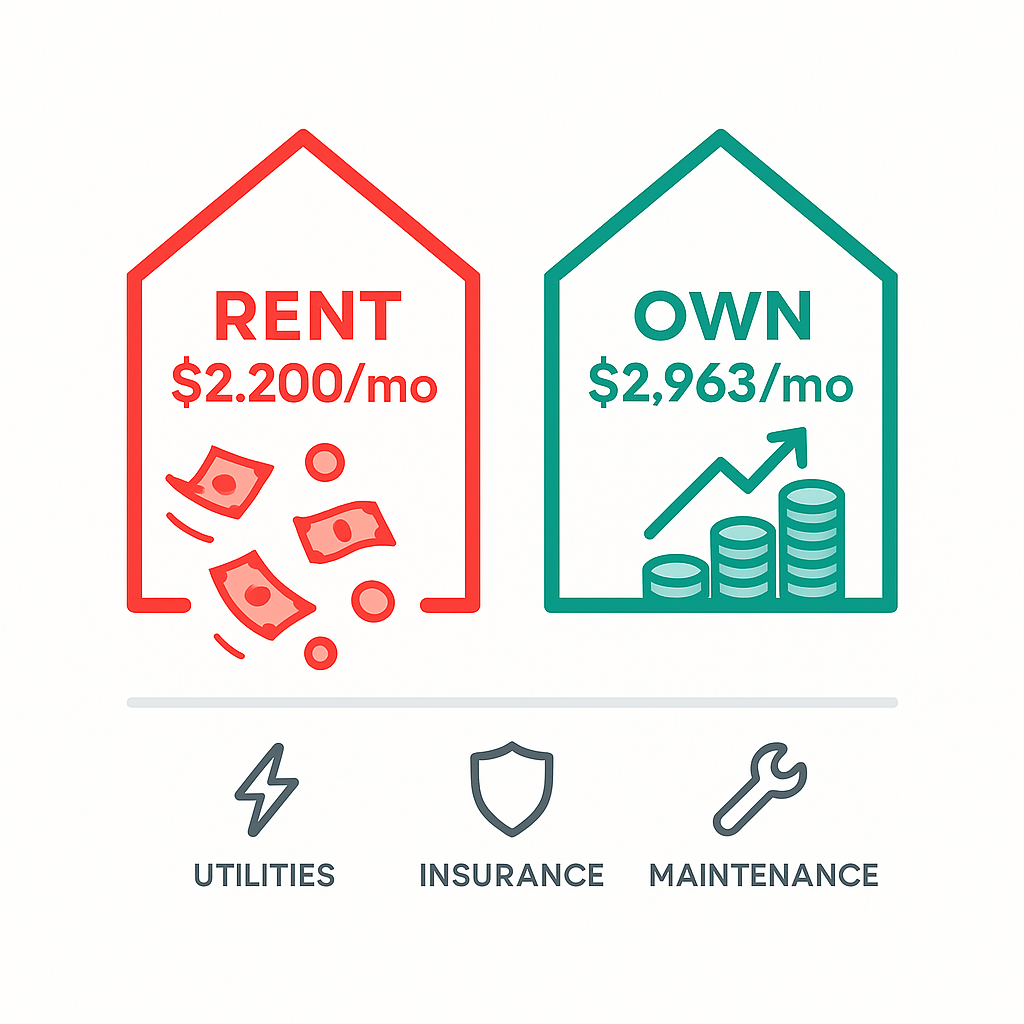

Monthly Housing Payment Comparison

Monthly Housing Payment Comparison

Renting Single-Family Homes in Davenport:

- Average rent: $2,200/month

- Renters insurance: ~$25/month

- Utilities (typically separate): $150-250/month

- Total monthly housing cost: ~$2,375-2,475

Buying a Home in Davenport (Median Price $364,627): Based on a 20% down payment and current mortgage rates

- Monthly mortgage payment (6.93% rate): $1,923

- Property taxes: $369/month

- Homeowners insurance: $367/month

- Maintenance fund (1% annually): $304/month

- Total monthly homeownership cost: $2,963

The Real Cost Difference: $588 More to Own vs Rent

While homeownership costs $588 more monthly, homeowners build equity through mortgage principal payments, while renters build zero wealth. Each mortgage payment reduces your loan balance and increases your home equity.

Down Payment and Closing Costs: What First-Time Buyers Need

Upfront Costs to Rent in Davenport:

- Security deposit: $2,200

- First month's rent: $2,200

- Last month's rent (if required): $2,200

- Total move-in costs: $4,400-$6,600

Upfront Costs to Buy a Home in Davenport:

- Down payment (20%): $72,925

- Closing costs (2-5%): $7,293-$18,231

- Home inspection and appraisal: $800-1,200

- Moving expenses: $2,000-5,000

- Total upfront investment: $83,018-$97,356

First-Time Homebuyer Programs Reduce Costs:

- FHA loans: Only 3.5% down ($12,762)

- VA loans: 0% down for veterans

- USDA loans: 0% down for eligible areas

- Florida Housing Finance Corporation: Up to $10,000 assistance

- Polk County programs: Up to $7,500 down payment help

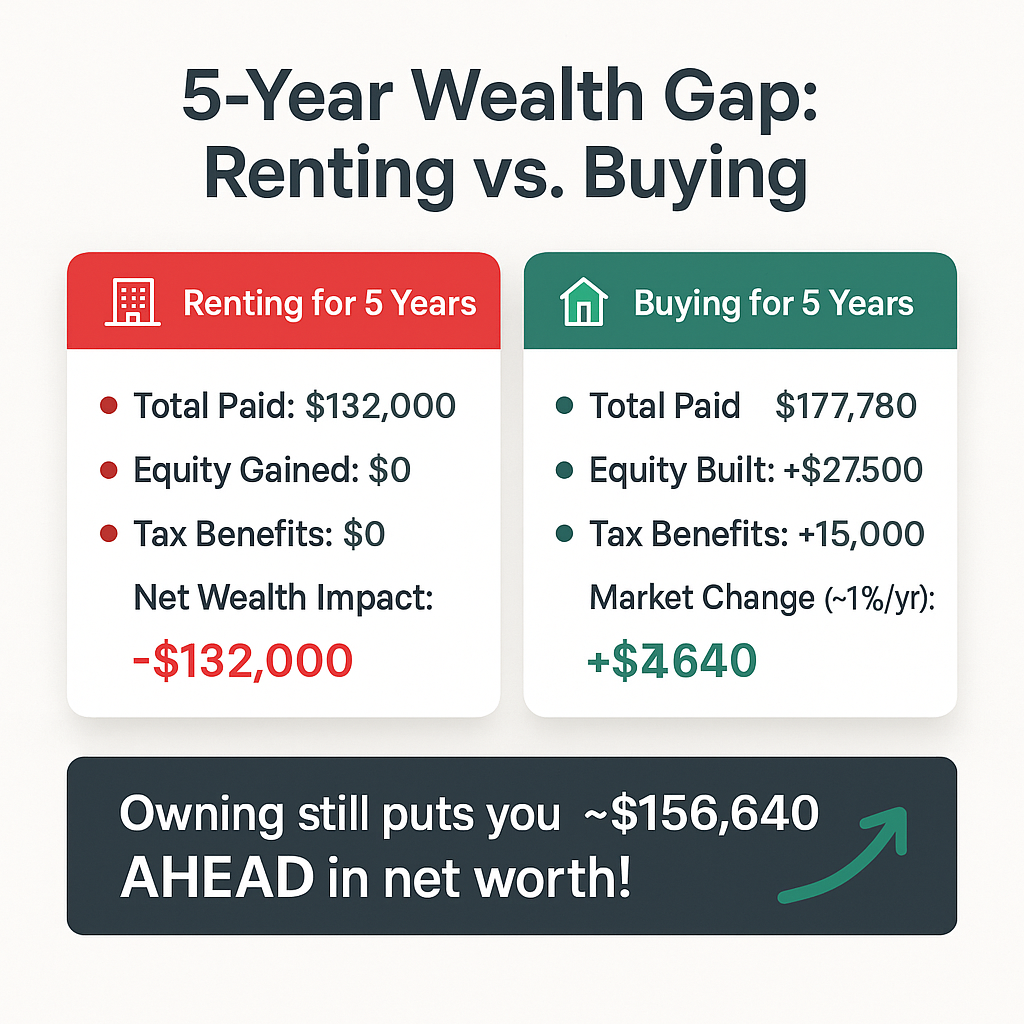

5-Year Wealth Building Analysis: Rent vs Buy in Davenport, FL

Financial Impact of Renting (5 Years):

- Total rent payments: $132,000

- Equity accumulated: $0

- Tax benefits: None

- Net worth change: -$132,000

Financial Impact of Homeownership (5 Years):

- Total housing payments: $177,780

- Mortgage principal paid down: $27,500

- Property value change (-1% annually): -$17,860

- Tax deductions (estimated): $15,000

- Net equity gain: $24,640

Bottom Line: Even with modest market depreciation, homeowners end up $156,640 ahead of renters after 5 years due to forced savings through mortgage payments.

Florida Homeowner Tax Benefits You Can't Get as a Renter

Exclusive advantages for Davenport homeowners:

- Homestead exemption: Save up to $50,000 off property taxes

- Mortgage interest deduction: Federal tax savings on interest paid

- Property tax deduction: Additional federal deduction

- No Florida state income tax: Keep more of your paycheck

- Capital gains exclusion: Up to $500k tax-free profit when selling

These benefits can reduce your effective housing costs by $200-500 monthly compared to renting.

When Renting Makes Sense vs When to Buy a House in Davenport

Choose Renting If:

✓ Planning to move within 2-3 years

✓ Prefer maintenance-free living

✓ Need maximum flexibility

✓ Building credit or saving for a larger down payment

✓ Uncertain about long-term job stability

Choose Homeownership If:

✓ Staying in Davenport 3+ years

✓ Want to build long-term wealth

✓ Ready for homeownership responsibilities

✓ Seeking tax advantages

✓ Desire stable housing payments

✓ Want control over your living space

Davenport FL Real Estate Market Trends (June 2025)

Current market conditions favor prepared buyers:

- Inventory levels: Improving with more homes available

- Competition: Fewer bidding wars than 2020-2022

- Interest rates: Stabilizing around 7% for qualified buyers

- Price trends: Modest corrections creating opportunities

- New construction: Active development in Champions Gate, Solara Resort areas

Local market drivers supporting long-term values:

- Disney World expansion plans

- New job centers in Polk County

- I-4 Ultimate completion improving commutes

- Population growth from Northeast relocations

Best First-Time Homebuyer Programs in Davenport, Florida

Federal Programs:

- FHA loans: 3.5% down, flexible credit requirements

- VA loans: 0% down for military veterans

- USDA loans: 0% down for eligible rural areas near Davenport

Florida State Programs:

- Florida Assist: $10,000 deferred payment loan at 0% interest

- Florida First-Time Homebuyer Program: Below-market interest rates

- Military programs: Additional benefits for service members

Local Polk County Assistance:

- Housing Finance Authority: Up to $7,500 down payment assistance

- City of Davenport programs: Closing cost assistance

- Habitat for Humanity: Affordable homeownership options

Rent vs Buy Decision Framework for Davenport Buyers

Ask yourself these key questions:

- How long will you stay? The break-even point is typically 3-4 years

- Is your income stable? Ensure a 6-month emergency fund beyond the down payment

- Are you ready for maintenance? Budget 1-2% of home value annually

- What are interest rates? Current rates are around 7% for qualified buyers

- Do you want tax benefits? Homeownership provides significant deductions

Use this simple formula: If (Monthly Rent × 15) > Home Purchase Price, buying likely makes financial sense.

For Davenport: $2,200 × 15 = $330,000. Since median home prices ($364,627) slightly exceed this threshold, consider your personal timeline and down payment options.

Current Home Buying Opportunities in Davenport, FL

Best neighborhoods for first-time buyers:

- Providence: New construction, family-friendly

- Windsor at Westside: Resort-style amenities

- Solara Resort: Vacation rental potential

- ChampionsGate: Golf course community

- Ridgewood Lakes: Established neighborhood values

Price ranges by area:

- New construction homes: $350,000-450,000

- Resale homes: $280,000-380,000

- Townhomes/condos: $220,000-320,000

- Investment properties: $200,000-350,000

Ready to Buy Your First Home in Davenport, FL?

Making the rent vs buy decision requires expert local market knowledge and personalized financial analysis. As your trusted Davenport real estate agent, I help first-time buyers navigate this complex decision with confidence.

¿Prefieres hablar en español? ¡Perfecto! Ofrezco servicios completos en español para compradores de primera vivienda en Davenport y todo el condado de Polk.

How I Help First-Time Homebuyers:

🏠 Free buyer consultation analyzing your specific situation

📊 Personalized rent vs buy calculator for your budget

🏦 Lender connections specializing in first-time buyer programs

📍 Local market expertise in Davenport neighborhoods

🗣️ Bilingual support throughout the entire process

💰 Down payment assistance program guidance

🔍 Home search matching your needs and budget

Ready to explore Davenport homeownership? Contact me today for your complimentary consultation. Let's create a personalized strategy to make your first home purchase a reality.

Call or text: 954-418-2463

Email: ndperez729@gmail.com

Schedule online: https://calendly.com/ndperez729/30min

Frequently Asked Questions: Davenport, FL Rent vs Buy

Q: Is it cheaper to rent or buy in Davenport, FL? A: While renting costs less monthly ($2,200 vs $2,963), buying builds wealth through equity and provides tax benefits that often make ownership more cost-effective long-term.

Q: What credit score do I need to buy a house in Davenport? A: FHA loans require a minimum 580 credit score with 3.5% down, or 500 with 10% down. Conventional loans typically need a 620+ for the best rates.

Q: How much down payment do I need for a Davenport home? A: First-time buyers can purchase with as little as 3-3.5% down through FHA loans, or 0% down with VA/USDA loans if eligible.

Q: Are Davenport home prices going up or down? A: The Current market shows modest price corrections after rapid 2020-2022 growth, creating opportunities for prepared buyers in June 2025.

Disclaimer: This analysis reflects current Davenport FL market conditions as of June 2025. Individual results vary based on specific properties, credit profiles, and loan programs. Consult with a qualified real estate professional and mortgage lender for personalized advice.

Categories

- All Blogs (26)

- Lakeland Real Estate, Market Insights, Central Florida, Investment Opportunities, Relocation (1)

- ADU, Real Estate Investing, Central Florida, Polk County (1)

- Davenport (4)

- florida market (4)

- Knowlege is Power When it comes to todays market (2)

- New Rules (1)

- Personal Finance," "Credit Score," "Money Tips (1)

- renting (2)

Recent Posts

Real Estate Professional | License ID: SL3558188

+1(954) 418-2463 | ndperez729@gmail.com